Retirement planning has evolved significantly over the past decade. With increasing life expectancies, changing pension landscapes, and economic uncertainties, building a secure retirement requires more strategic planning than ever before. Whether you're just starting your career or approaching retirement age, understanding modern retirement planning strategies is essential for achieving financial independence and maintaining your desired lifestyle in your golden years.

The New Retirement Reality

Today's retirees face a fundamentally different landscape than previous generations. Traditional pension plans are becoming increasingly rare, replaced by defined-contribution plans like 401(k)s that place the responsibility for retirement savings squarely on individuals. At the same time, we're living longer than ever—many retirees can expect to spend 20 to 30 years or more in retirement.

This new reality requires a more proactive and sophisticated approach to retirement planning. It's no longer enough to simply save a percentage of your income; you need a comprehensive strategy that accounts for longevity risk, healthcare costs, inflation, and market volatility.

1. Start Early and Save Consistently

The power of compound interest cannot be overstated. Starting to save for retirement in your 20s or early 30s gives your investments decades to grow. Even small contributions can accumulate significantly over time. For example, saving just $500 per month starting at age 25 could result in over $1.5 million by age 65, assuming a 7% average annual return.

If you're starting later, don't despair. While you may need to save more aggressively, it's never too late to improve your retirement prospects. The key is to start now and maintain consistency in your savings habits.

2. Maximize Tax-Advantaged Accounts

Taking full advantage of tax-advantaged retirement accounts should be a cornerstone of your retirement strategy. In 2026, the contribution limits are:

- 401(k): $23,500 per year (plus $7,500 catch-up for those 50 and older)

- Traditional/Roth IRA: $7,000 per year (plus $1,000 catch-up for those 50 and older)

- SEP IRA (for self-employed): Up to $69,000 or 25% of compensation

If your employer offers a 401(k) match, prioritize contributing at least enough to capture the full match—this is essentially free money that can significantly boost your retirement savings.

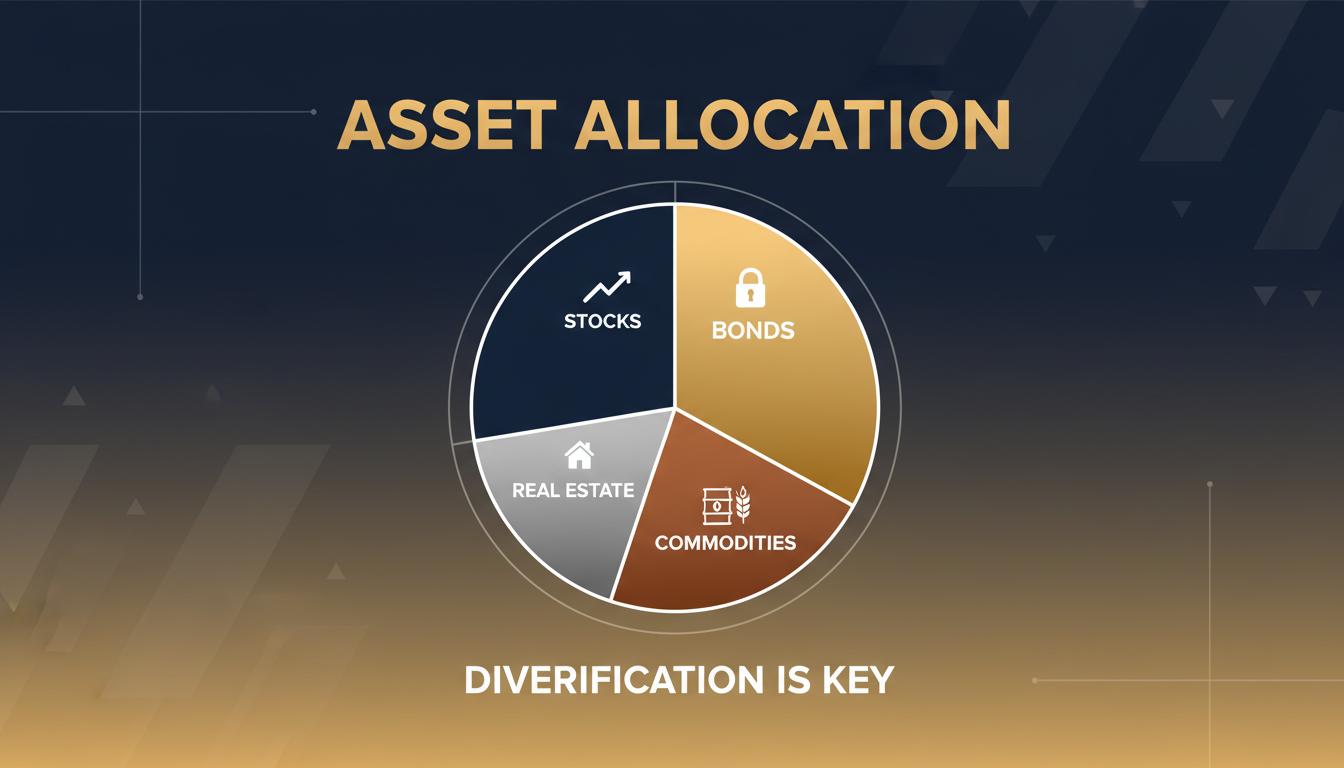

3. Diversify Your Retirement Income Sources

Relying on a single source of retirement income is risky. A well-rounded retirement plan should include multiple income streams:

- Social Security: Understand your benefits and the optimal time to start claiming

- Retirement accounts: 401(k), IRA, and other tax-advantaged savings

- Taxable investment accounts: Provide flexibility and tax diversification

- Annuities: Can provide guaranteed lifetime income

- Part-time work: Many retirees choose to work part-time for additional income and engagement

- Rental income: Real estate investments can provide steady cash flow

4. Plan for Healthcare Costs

Healthcare is often one of the largest expenses in retirement, and costs continue to rise. A 65-year-old couple retiring in 2026 can expect to spend an average of $315,000 on healthcare throughout retirement. This doesn't include long-term care costs, which can be substantial.

Strategies to manage healthcare costs include:

- Maximizing Health Savings Account (HSA) contributions while working

- Understanding Medicare coverage and supplemental insurance options

- Considering long-term care insurance

- Maintaining a healthy lifestyle to reduce future healthcare needs

5. Develop a Withdrawal Strategy

How you withdraw money from your retirement accounts can significantly impact how long your savings last. The traditional 4% rule—withdraw 4% of your portfolio in the first year, then adjust for inflation—provides a starting point, but may need adjustment based on market conditions and personal circumstances.

Consider these withdrawal strategies:

- Tax-efficient sequencing: Withdraw from taxable accounts first, then tax-deferred, then Roth

- Dynamic spending: Adjust withdrawals based on market performance

- Buckets strategy: Segment your portfolio by time horizon and risk level

6. Consider Roth Conversions

Converting traditional IRA or 401(k) assets to Roth accounts can be a powerful strategy, especially during years when your income is lower. While you'll pay taxes on the converted amount, future withdrawals from Roth accounts are tax-free, providing valuable tax diversification in retirement.

7. Don't Forget About Inflation

Inflation can significantly erode your purchasing power over a long retirement. Even at a modest 3% annual inflation rate, the cost of living will double in about 24 years. Your investment strategy should include assets that have the potential to outpace inflation, such as stocks, real estate, and Treasury Inflation-Protected Securities (TIPS).

Working with a Professional

Retirement planning is complex, and the stakes are high. Working with a qualified financial advisor can help you navigate the many decisions involved and create a personalized plan that addresses your specific situation and goals. At Vessel Capital, we specialize in retirement planning and can help you build a comprehensive strategy for your golden years.

Remember, the best retirement plan is one that you actually follow. Start today, stay consistent, and regularly review and adjust your strategy as your life circumstances change. Your future self will thank you.

About Emily Wong

Senior Portfolio Manager at Vessel Capital

Emily has over 15 years of experience in wealth management and retirement planning. As a CFA and CFP certified professional, she specializes in helping high-net-worth clients and families create comprehensive retirement strategies that align with their lifestyle goals and values.