The financial technology landscape is evolving at an unprecedented pace. As we move through 2026, we're witnessing a transformation that's fundamentally changing how individuals and institutions manage, invest, and interact with money. From artificial intelligence-powered investment platforms to blockchain-based financial services, the innovations emerging today are reshaping the future of finance.

1. AI-Powered Investment Management

Artificial intelligence has moved from experimental technology to a core component of modern investment management. In 2026, AI algorithms are analyzing vast amounts of market data, news sentiment, and economic indicators in real-time to make investment decisions faster and more accurately than human traders.

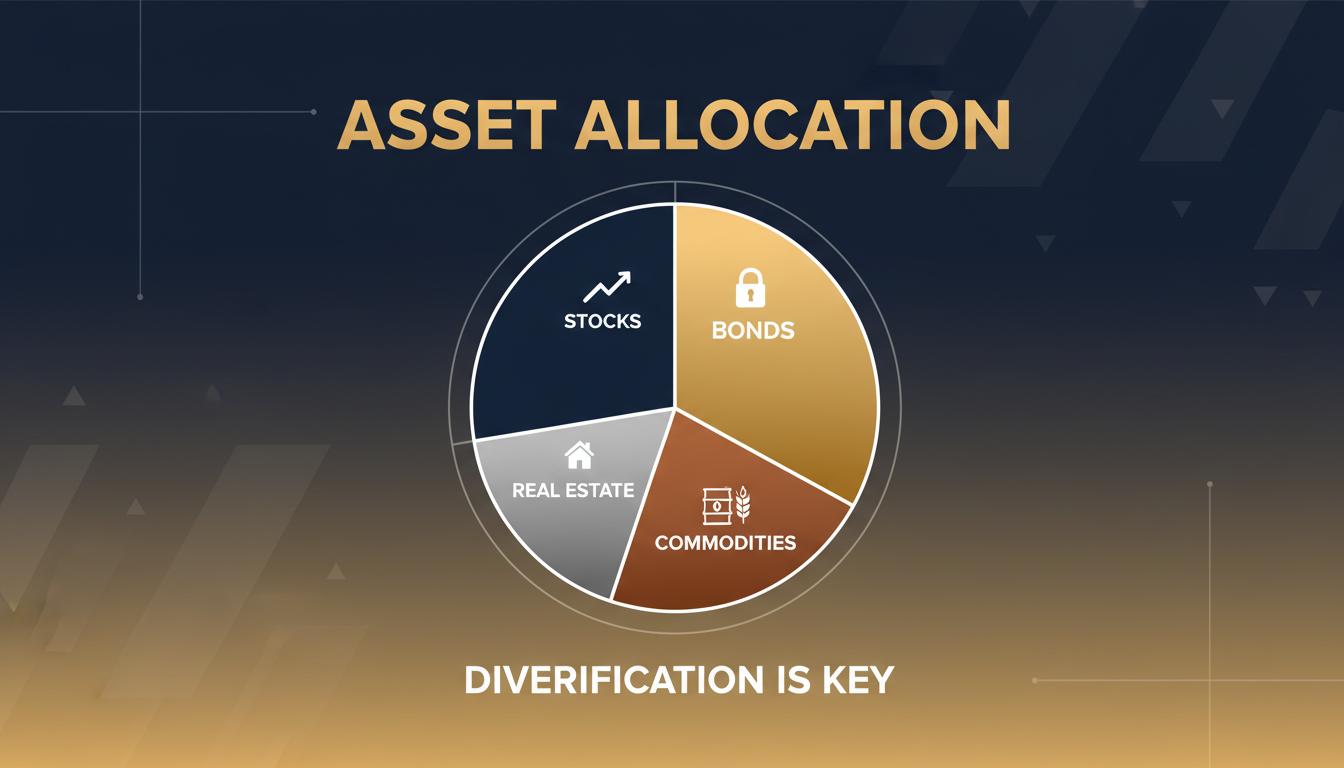

Robo-advisors have evolved beyond simple portfolio allocation. Today's AI-powered platforms offer sophisticated tax-loss harvesting, dynamic rebalancing, and personalized investment strategies based on individual risk profiles and financial goals. These platforms are democratizing access to investment strategies that were once available only to high-net-worth individuals.

2. Blockchain and DeFi Maturation

Blockchain technology has moved beyond its cryptocurrency origins to become a foundational infrastructure for financial services. Decentralized Finance (DeFi) platforms are now offering traditional banking services—lending, borrowing, and trading—without intermediaries, reducing costs and increasing accessibility.

Central Bank Digital Currencies (CBDCs) are gaining traction worldwide, with several major economies launching or piloting their digital currencies. These government-backed digital currencies promise faster, cheaper, and more secure transactions while providing central banks with new monetary policy tools.

3. Embedded Finance Revolution

Embedded finance—the integration of financial services into non-financial platforms—is transforming how consumers access banking, payments, and investment services. From e-commerce sites offering instant financing to ride-sharing apps providing banking services, financial capabilities are becoming seamlessly integrated into everyday experiences.

This trend is particularly significant for investment management, as we're seeing investment capabilities being embedded into payroll systems, allowing employees to automatically invest a portion of their earnings with each paycheck. Similarly, round-up investment features in payment apps are making micro-investing effortless.

4. Open Banking and Data Portability

Open banking initiatives are giving consumers greater control over their financial data. Through secure APIs, individuals can now share their financial information with authorized third parties, enabling personalized financial advice, better loan terms, and more comprehensive financial planning tools.

For investors, this means access to more sophisticated portfolio analysis tools that can aggregate data from multiple accounts and institutions, providing a holistic view of their financial position and enabling more informed investment decisions.

5. Sustainable and Impact Investing Technology

Environmental, Social, and Governance (ESG) investing has grown exponentially, and technology is making it easier than ever for investors to align their portfolios with their values. Advanced screening tools can now analyze thousands of data points to evaluate companies' ESG performance, while blockchain technology is providing unprecedented transparency in supply chains.

Impact measurement platforms are enabling investors to track the real-world outcomes of their investments, from carbon emissions reduced to communities positively affected. This data-driven approach to impact investing is attracting a new generation of socially conscious investors.

What This Means for Investors

These technological advancements are creating both opportunities and challenges for investors. On one hand, access to sophisticated investment tools and strategies has never been more democratized. On the other hand, the rapid pace of change requires investors to stay informed and adapt their approaches.

At Vessel Capital, we're embracing these innovations while maintaining our commitment to personalized, human-centered investment advice. Technology enhances our capabilities, but our focus remains on understanding each client's unique financial situation and goals.

Looking Ahead

As we look to the future, the convergence of these technologies promises even more transformative changes. Quantum computing could revolutionize risk modeling and portfolio optimization. Augmented reality might change how we visualize and interact with our financial data. And as artificial intelligence continues to evolve, the line between human and machine-driven investment decisions will likely become increasingly blurred.

The key for investors is to remain adaptable and open to new technologies while maintaining a focus on fundamental investment principles. The tools may change, but the goal remains the same: building and preserving wealth to achieve financial security and peace of mind.

About Sarah Chen

Chief Financial Officer at Vessel Capital

Sarah brings over 20 years of experience in corporate finance and strategic planning. As a CPA and CFA charterholder, she oversees Vessel Capital's financial operations and guides the firm's technology investment strategy, ensuring we remain at the forefront of financial innovation.