In today's rapidly evolving financial landscape, investment diversification remains one of the most fundamental principles for building and preserving wealth. As we navigate through 2026, understanding how to effectively diversify your portfolio has never been more critical. This comprehensive guide will walk you through the essential strategies and considerations for creating a resilient, well-balanced investment portfolio.

Why Diversification Matters More Than Ever

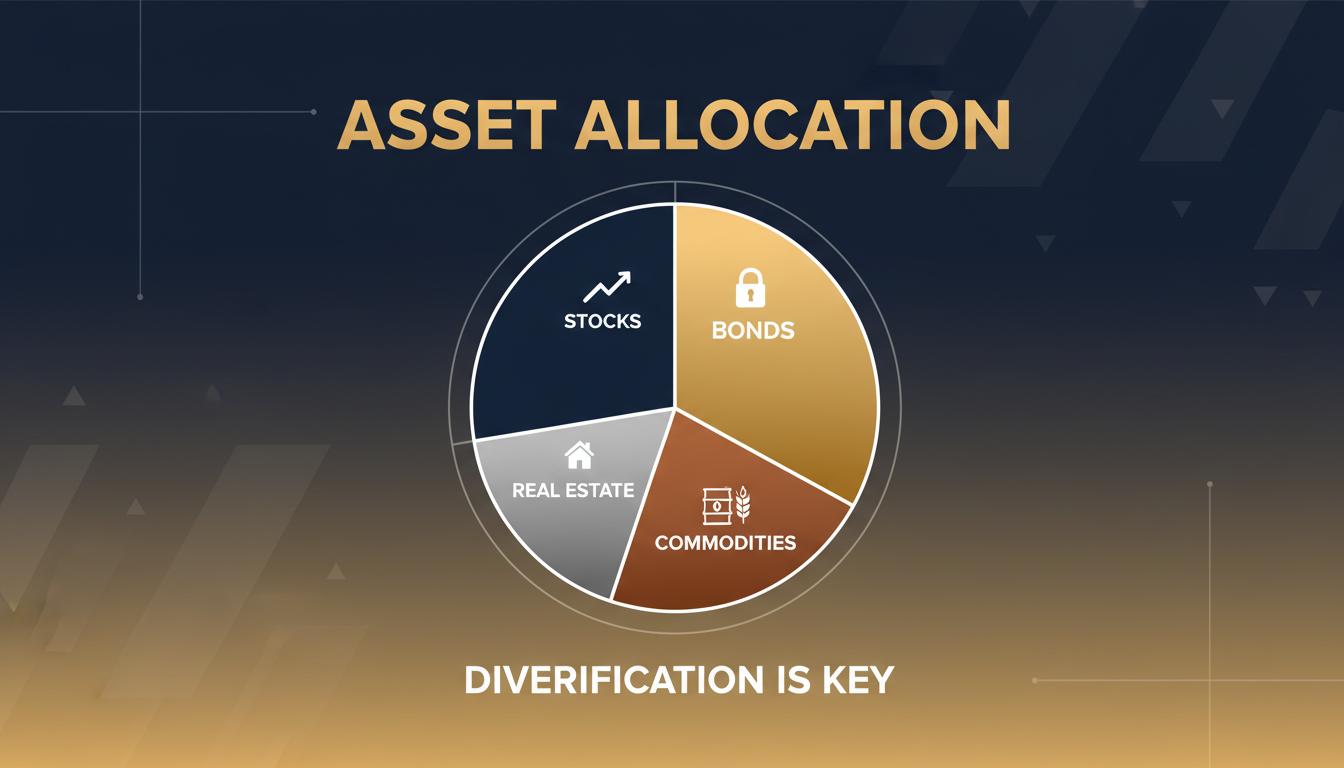

The concept of diversification is elegantly simple: don't put all your eggs in one basket. However, in practice, effective diversification requires a sophisticated understanding of how different asset classes interact with each other, especially during periods of market volatility. The events of recent years have demonstrated that traditional diversification strategies may no longer be sufficient in our interconnected global economy.

Modern portfolio theory, pioneered by Harry Markowitz in the 1950s, taught us that diversification can reduce risk without necessarily sacrificing returns. Today, this principle remains as relevant as ever, but the tools and assets available to investors have expanded dramatically. From traditional stocks and bonds to alternative investments like cryptocurrencies, real estate investment trusts (REITs), and commodities, the modern investor has unprecedented opportunities for diversification.

The Core Components of a Diversified Portfolio

1. Equities: The Growth Engine

Stocks remain the cornerstone of most investment portfolios, offering the potential for long-term capital appreciation. However, within the equity portion of your portfolio, diversification is crucial. This means spreading investments across:

- Geographic regions: Domestic and international markets, including developed and emerging economies

- Market capitalizations: Large-cap, mid-cap, and small-cap companies

- Sectors: Technology, healthcare, finance, consumer goods, energy, and more

- Investment styles: Growth, value, and blend strategies

2. Fixed Income: The Stability Anchor

Bonds and other fixed-income securities provide stability and regular income to your portfolio. In 2026, with interest rate environments continuing to evolve, a well-structured fixed-income allocation should include:

- Government bonds (Treasuries, municipal bonds)

- Corporate bonds (investment-grade and high-yield)

- International bonds

- Inflation-protected securities (TIPS)

- Short-term and intermediate-term maturities for flexibility

3. Alternative Investments: The Diversification Boosters

Alternative investments can provide returns that are less correlated with traditional markets, enhancing overall portfolio diversification. Consider allocating a portion of your portfolio to:

- Real Estate: REITs, direct property investments, or real estate crowdfunding platforms

- Commodities: Gold, silver, oil, and agricultural products

- Private Equity: Investments in private companies

- Hedge Funds: Strategies designed to generate returns in various market conditions

- Cryptocurrencies: Bitcoin, Ethereum, and other digital assets (with appropriate risk management)

Strategic Asset Allocation for 2026

Determining the right asset allocation depends on several factors, including your age, risk tolerance, investment timeline, and financial goals. While there's no one-size-fits-all approach, here are some general guidelines for different investor profiles:

Conservative Investor (Age 50+)

- • 40% Stocks (emphasis on dividend-paying, large-cap companies)

- • 50% Bonds (mix of government and high-quality corporate)

- • 10% Alternatives (REITs, commodities)

Moderate Investor (Age 30-50)

- • 60% Stocks (diversified across sectors and geographies)

- • 30% Bonds (mix of durations and credit qualities)

- • 10% Alternatives (REITs, commodities, small crypto allocation)

Aggressive Investor (Age 20-40)

- • 80% Stocks (including international and emerging markets)

- • 15% Bonds (shorter duration for flexibility)

- • 5% Alternatives (higher allocation to growth-oriented alternatives)

The Importance of Regular Rebalancing

Creating a diversified portfolio is not a one-time task. Market movements will naturally cause your asset allocation to drift from its target over time. Regular rebalancing—typically quarterly or annually—ensures that your portfolio maintains its intended risk profile and diversification benefits.

For example, if your stock holdings have performed exceptionally well and now represent a larger portion of your portfolio than intended, rebalancing would involve selling some stocks and buying other assets to return to your target allocation. This disciplined approach helps you "buy low and sell high" systematically.

Common Diversification Mistakes to Avoid

Even experienced investors can fall into diversification traps. Here are some common mistakes to watch out for:

- Over-diversification: Holding too many investments can dilute returns and make portfolio management unwieldy. Focus on quality over quantity.

- Home bias: Investing too heavily in your home country's markets. Global diversification is essential in today's interconnected world.

- Correlation blindness: Assuming assets are diversified when they're actually highly correlated. During market stress, previously uncorrelated assets may move together.

- Ignoring costs: High fees can significantly erode returns over time. Consider low-cost index funds and ETFs for core holdings.

- Emotional decision-making: Abandoning your diversification strategy during market volatility. Stay disciplined and stick to your plan.

Tools for Building a Diversified Portfolio

Modern investors have access to powerful tools for building and maintaining diversified portfolios:

- Index Funds and ETFs: Provide instant diversification across hundreds or thousands of securities with low fees

- Target-Date Funds: Automatically adjust asset allocation based on your retirement date

- Robo-Advisors: Use algorithms to create and manage diversified portfolios based on your goals and risk tolerance

- Portfolio Analysis Tools: Help you understand your true diversification and risk exposure

Conclusion: Your Path to a Diversified Future

Investment diversification is both an art and a science. While the principles are straightforward, implementing an effective diversification strategy requires careful planning, ongoing monitoring, and periodic adjustments. As we progress through 2026, the importance of a well-diversified portfolio cannot be overstated.

Remember that diversification is not about eliminating risk—it's about managing it intelligently. By spreading your investments across various asset classes, geographies, and sectors, you position yourself to weather market storms while capturing growth opportunities.

At Vessel Capital, we specialize in creating personalized diversification strategies tailored to each client's unique financial situation and goals. If you're ready to build a more resilient portfolio, we invite you to schedule a consultation with one of our expert advisors.

About David Martinez

Head of Investment Advisory at Vessel Capital

David brings over 18 years of experience in portfolio management and investment strategy. A CFA charterholder, he specializes in global equity and fixed income strategies, helping clients build resilient, diversified portfolios that stand the test of time.